Are you looking for a reliable tool to help you assess the stock market and make more informed investment decisions? Have you heard of the High-Low Index (or HLI) but need clarification on what it is and how it works? If so, read on!

In this blog post, we'll discuss the High-Low Index and how it can be used to analyze equity markets.

We'll also explore some of its uses in portfolio management and uncover why some investors utilize this unique measure when making strategic decisions related to their investments.

With an understanding of this important index, investors like yourself can gain insight into current market conditions that will guide savvy decision-making now – and well into the future.

What Is The High-Low Index, and Why Is It Important To Investors And Businesses Alike

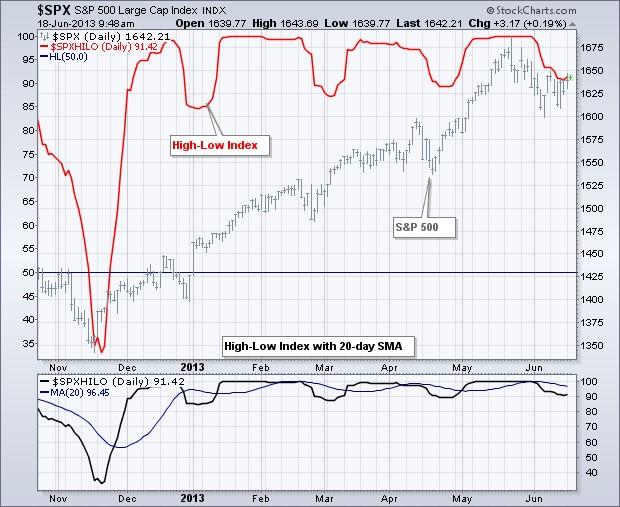

The High-Low Index, or HLI, is a technical tool for analyzing equity markets. This index measures the ratio of the highest price to the lowest price over a given period. It has become an increasingly popular measure for investors who want to better understand the stock market’s performance.

The HLI can identify trend reversals, as a low index indicates the market is becoming more bearish, while a high index indicates bullishness. It can also identify potential buy or sell signals in the markets.

By analyzing these signals over time, investors and businesses can better understand overall market movements and make smarter investment decisions.

In addition to being an important tool for investors, the HLI can also be used by businesses to assess market sentiment and make informed decisions on how best to allocate resources.

By tracking the HLI regularly, businesses can stay up-to-date with market trends and react quickly should any significant changes occur.

The High-Low Index is invaluable for investors and businesses who want to better understand the markets and make smarter, more informed investment decisions.

By closely tracking the HLI over time, investors can gain valuable insight into equity market movements and identify potential buy or sell signals to maximize their investments. Similarly, businesses can use this index to better assess market sentiment and allocate resources more effectively.

Whatever your reasons for using it, the High-Low Index is a powerful tool that can help you stay informed about equity markets and make smarter investment decisions.

How To Use The High-Low Index To Measure Market Volatility And Identify Trends

The High-Low Index (HLI) is a technical indicator that offers insight into the volatility of an equity market.

It's calculated by taking the difference between the day's highest and lowest traded prices, then dividing that figure by the prior day's closing price. This calculation measures how much an index or stock has moved in one day.

The HLI can be used to identify trends in the stock market over time and measure the overall market volatility. If the High-Low Index rises, then prices increase due to increased buying. Conversely, a declining High-Low Index suggests that prices are falling due to increased selling.

For investors, the High-Low Index can identify market trends and gauge overall market sentiment. It's also useful for portfolio management, as it can help investors determine when to buy or sell a stock based on its volatility.

Finally, traders may use the High-Low Index as part of their analysis for short-term trading strategies. By monitoring the HLI, traders can identify potential market buying and selling opportunities.

An Overview of How The High-Low Index Is Calculated And Its Components

The High-Low Index (HLI) measures the relative prices of stocks in an equity index. It is calculated by taking the difference between the highest and lowest observed closing price within a given period, usually one day or one week.

In essence, it measures the volatility of a stock market over time and can be used to identify market trends.

The HLI comprises two key components: the High-Low Range (HLR) and the High-Low Difference (HLD). The HLR measures the range of stock prices between the highest and lowest levels observed during a given period, while the HLD measures the difference from one observation point to another.

The HLI is calculated by subtracting the HLD from the HLR, which produces a figure that reflects the overall volatility of the stock market at any given point in time. This number can then be used to identify trends and make better-informed investment decisions.

Examples Of How the High-Low Index Can Be Used To Make Informed Investment Decisions

The High-Low Index can be used in various ways to help inform strategic investment decisions. Here are some examples:

Trend Analysis

The HLI is an effective tool for analyzing the market's overall trend, as it compares the highs and lows of a given period. This allows investors to identify whether the market is trending up, down, or sideways and make informed decisions on when to enter or exit the market.

Portfolio Diversification

The HLI can identify sectors that are performing well or poorly, which can help investors determine where they should focus their investments for greater returns. By diversifying their portfolios across multiple sectors, investors can reduce their risk exposure and maximize their potential returns.

Risk Mitigation

The HLI can also be used to identify undervalued or overvalued stocks to mitigate risks associated with investing. By carefully analyzing the highs and lows of stocks, investors can identify when they should enter or exit a particular stock to maximize their profits.

Tips for tracking changes in the High-Low Index over time

A few tips for tracking changes in the High-Low Index include the following.

Monitor daily highs and lows.

Keeping a close eye on individual stocks' daily highs and lows can help you recognize when extended moves up or down are beginning to take place. This helps identify possible entry points for investments and potential times to exit existing positions.

Pay attention to the breadth.

The number of stocks making new highs versus those making new lows can provide an additional layer of insight into the overall trend in the market. If more stocks are making new highs, the HLI is likely trending higher, indicating bullish sentiment. On the other hand, if more stocks are making new lows than new highs, it’s time for caution.

Compared with other indices.

Comparing the High-Low Index to other major indices can provide additional insight into what type of market conditions may be present. For example, if the S&P 500 is up while the HLI is down, this could indicate underlying weakness and potentially a bearish sentiment.

FAQs

What is a low-index number?

A low index indicates that the market has a relatively high fear and pessimism among participants. On the other hand, a high index number suggests an atmosphere of more optimism and confidence in the markets.

What are some uses for the High-Low Index?

The High-Low Index can be used to measure changes in investor sentiment in the equity market. Investors can use this measure to gauge the direction of a stock's price since it measures how much fear or optimism is currently present.

How is the High-Low Index calculated?

The High-Low Index is calculated by dividing the number of advancing stocks (stocks that closed higher than their previous close) by the total number of declining stocks (stocks that closed lower than their previous close). This ratio gives investors an idea of market sentiment and whether fear or optimism exists.

Conclusion

This concludes our overview of the High-Low Index—what it is, why it's important, how to use it to measure market volatility and identify trends, how to calculate it, and what examples of it might look like in action. There are many tools to make informed investment decisions, and tracking changes in the High-Low Index over time is a great way to stay up-to-date. It provides investors with insights into the market and can help businesses adjust their approach based on current economic conditions.